Enterprise Resource Planning systems (ERP) are the central instrument of corporate management today. They have been established in almost all companies as the means of increasing the efficiency and transparency of the tasks and processes in finance as well as in relevant areas of order processing (sales, materials management, production planning and control and project management). ERP systems also play an important role in the wake of the increasing digitalisation of business processes: They serve as the „Single Source of Truth“ where central master data and transaction data from the value chain are concerned (e.g. material, article and customer master).

Thus, ERP software is an important factor for a company’s business success. During the past ten years, Trovarit has regularly studied the reality of ERP in companies by asking the users for their experiences. The survey „ERP in Practice“ examines both the benefits of ERP usage and the challenges posed by ERP implementation and ERP operation. One of the study’s focuses is on the users‘ satisfaction with their ERP systems and the services rendered by the vendors. Finally, important trends and developments concerning ERP usage and the ERP market are revealed and evaluated from the point of view of the users.

The survey has been conducted for the seventh time since 2004. The international research team consisted of experts from the FIR, ERP-Tuner/Vienna, 2BCS AG / St. Gallen, pragmatiQ/Zoetermeer and Trovarit Ltd./Istanbul. The broad empirical basis is used to elicit which systems are installed in the companies, what they are used for and how they are managed. Finally, the study shows how satisfied the users are in daily practice.

Specialisation, Up-To-Date Releases and Customer Care are Rewarded

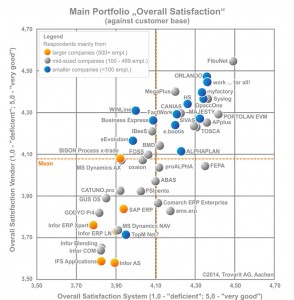

As in the years before, „lean“ ERP solutions, solutions for specific industries and/or solutions from smaller vendors perform best, whose customers are mainly smaller or middle-sized companies. The best solutions for larger companies can be found in the second half of the field. However, the portfolio also shows that specialists and smaller ERP vendors or systems are not guaranteed a top position.

As in the years before, „lean“ ERP solutions, solutions for specific industries and/or solutions from smaller vendors perform best, whose customers are mainly smaller or middle-sized companies. The best solutions for larger companies can be found in the second half of the field. However, the portfolio also shows that specialists and smaller ERP vendors or systems are not guaranteed a top position.

Why do some of the smaller vendors get such good ratings?

Several reasons can be cited for this and backed up by further analyses:

Low complexity: Leaner and/or functionally focused ERP systems are less complex so that implementation and administration / updating are easier.

State-of-the-art technology: The installations are used in up-to-date releases and usually have good ergonomic user-interfaces and user-guidance.

Close and intact customer relationship: smaller, local or specialised vendors usually have a manageable customer base and thus far better possibilities to maintain intensive and individual relationships with their customers.

If one considers the ERP systems which are mainly used in smaller and mid-sized companies, one notices the good positions of industry-specific solutions like e.g. work … for all! (professional services), MAJESTY (precision and medical engineering), SIVAS (plant construction) or OpaccOne (wholesale and retail trade). Likewise, some of the ERP solutions which are mainly used in smaller companies perform above average, like e.g. TOSCA, the cloud solution myfactory, Orlando or HS – Hamburger Software. Most of these solutions are also marketed with a clear regional focus.

If one takes a closer look at the different satisfaction aspects, the picture is much more differentiated. On the x-axis, the portfolio shows the average degree of satisfaction for all examined aspects from all 2,393 analysed installations. The y-axis shows the stability of the ratings based on the variance of the single values – and thus , in reverse, the degree to which the different satisfaction parameters can be influenced, respectively how great a risk is attached to them.

ERP users can assume that aspects with a high stability in the ratings are relatively fixed. If the stable rating is rather good, you get the aspects which users can depend upon („Safe Basis“). If the stable rating is rather bad, one has found the aspects which pose a „Constant Challenge“. Aspects with a low stability can be influenced to a great degree either by the user or by the vendor. In the best case, this is where you know the „Wheat from the ChafF“ while in the worst case you recognise the aspects which are always in danger of giving „bad surprises“.

The aspects which should be kept an eye on during projecting are:

- system-related aspects like „mobile usage“, „forms and reports“, „internationality“, „costs of data maintenance“, „usability / user-friendliness“, „performance“ and „integration interfaces“

- classic project-related factors like „keeping to budget“, „keeping to schedule“ and „staff requirements“ as well as

- support-services like „offer of training and information“ or „consulting“ for the optimisation of ERP usage.

In fact, „mobile usage of the ERP software“ is the new aspect to bring up the rear. It seems that the limitless use of the ERP solutions at „any time and any place“ is not as real as users expect it to be today – especially when compared to other software applications, not least in the private area.

Overall, the „international deployment of ERP software“, which was analysed for the first time, also proves to be a weakness. The aspect gets a B- which indicates that there are great differences when it comes to addressing the different legal and language requirements which accompany the international deployment of a central ERP solution.

Compared to the results of 2012, a number of the former weaknesses, e.g. „releasability“ and „forms and reports“ as well as „commitment of the consultants during the project“ and „support for release changes“, get better marks. The ratings for „user training upon ERP implementation“ and „offer of training and information“, on the other hand, changed for the worse.

A more discriminating look at the satisfaction aspects shows, that the overall satisfaction with the ERP system and the vendor is high while there are important weaknesses in the particulars. If one looks at the satisfaction with the system, for example, it becomes obvious that the overall impression is rated far better than almost every single satisfaction aspect relating to the system. For ERP vendors this means that they have to go into detail when they are looking for improvement potentials.

A similar situation can be observed for the rating of the implementation project: Here, the positive overall ratings are proof of the typical characteristic of infrastructure projects, where the responsible employees tend to assess the situation better than it objectively is.

Topics and Trends in the Context of ERP

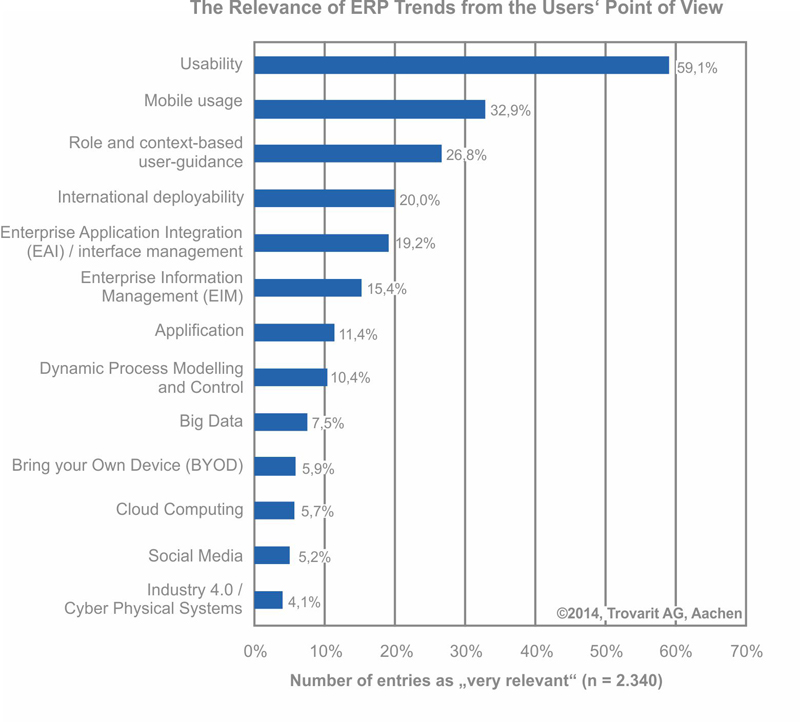

The study shows that the way users handle the systems and what they expect from their ERP systems change significantly over time. In 2014, the top drivers and trends are topics like „better usability“, „mobile use of ERP“ as well as a „role-based and context-related user-guidance“. These are directly related to the use of ERP software as a tool for everyday work.

The study shows that the way users handle the systems and what they expect from their ERP systems change significantly over time. In 2014, the top drivers and trends are topics like „better usability“, „mobile use of ERP“ as well as a „role-based and context-related user-guidance“. These are directly related to the use of ERP software as a tool for everyday work.

The mobile use of ERP software is common today – at least when one takes the term to mean the use via the internet on a laptop. The use over smart phones or tablet PCs requires a completely new designed user interface because of the limited space on the screens and operation via touch screen. A number of ERP vendors are working fervently on this new design.

Similarly problematic is the „offline ability“ of the ERP applications. In view of the still occurring gaps in the network coverage this remains a necessity.

The next positions in the topic ranking are taken up by „international deployability“, „Enterprise Application Integration or interface management“ and a comprehensive „Enterprise Information Management“. This points to a significant trend towards a better integration where the distribution or supply of information is concerned – be it across company levels, departments or even subsidiaries and regions: The aim seems to be to manage the resource „information“ more comprehensively and more target oriented in the future.

Some of the topics which are discussed in specialist media and circles, however, reveal significant need for clarification: Only 5.7 % of the respondents say that „cloud computing“ is very relevant in connection with ERP. When it comes to „Social Media“ the portion is even smaller at 5.2% and „Industry 4.0“ brings up the rear with a meagre 4.1%. Obviously, there is still a high demand for information: almost 40% of respondents admitted, that they did not know (yet) what the term „Industry 4.0“ meant. This is also true for topics like „Big Data“ or „Bring Your Own Device/BYOD“.